.png)

"We are proud to have received the London Stock Exchange’s Green Economy Mark, which recognises Harvest’s contribution to the global green economy and highlights our efforts to support the transition to a net zero economy.”

Brian McMaster, Executive Chairman

Harvest has one potash project in the Sergipe Alagoas Basin. Sergi (40km) is close to the only producing potash mine in Brazil, the Taquari-Vassouras potash mine which Vale recently sold to Mosaic and is close to the end of its useful mine life. As well as excellent infrastructure nearby including nitrate plants (Petrobras) and fertiliser blenders/ distributers such as Heringer, the state and the Department of Mines (DNPM) are very supportive of Harvest’s plans to develop a new potash project in the state and as such have provided access to ministers, historic data and assistance in permitting.

The Mandacaru project in Ceara State, Brazil was acquired by Harvest Minerals in December 2015. The project comprises three exploration licenses covering a total area of 5,908.67 hectares.

Exploration work, including a ground radiometric survey, mapping, surface rock sampling, trenching and a 2,141 metre diamond drilling programme over 32 holes, was completed by the asset’s former owner, B&A Mineração Ltda, in 2013. Harvest acquired this data in return for a 2% Net Smelter Royalty from future production (capped at an aggregate amount of US$1 million).

Independent consultants GE21 then estimated a JORC (2012) compliant total resource of 4.38Mt @ 4.55% P2O5, which includes an Indicated resource of 1.47Mt @ 5.30% P2O5 and Inferred resource of 2.91Mt @ 4.18% P2O5.

The Project has an estimated additional exploration potential of 4Mt of phosphate ore with similar grades, from the extension of the estimated mineralized layers, to be proven up by further exploration assessment. Although uranium and thorium are associated with the mineralisation, the grades are lower than 300 ppm indicating they will not impede the potential development of the Project.

Located in the State of Pernambuco, a predominantly agricultural state in Brazil, this advanced project comprises seven mineral rights spanning a total area of 6,112 hectares. Previously developed by the Brazilian Geological Agency, CPRM, which executed substantial exploration work, the project has an historical non-NI 43-101 inferred resources of 4.8 million tonnes at 4.19% P2O5.

The Company’s planned development strategy includes the certification of an international standard resource and commissioning a Preliminary Feasibility Study (‘PFS’) with the aim of fast-tracking the project to production.

Notably, as a simple Direct Application Natural Fertiliser operation, the project ticks the sustainable box, which is key given the growing demand for organic crop farming and increased focus on providing an all-natural solution to boost soil nutrition.

Located in the municipality of Iguatama, Minas Gerais, the Company holds mineral rights over an area highly prospective for the exploration of agriculture limestone, a critical soil input used to neutralise soil acidity by raising its pH levels and promote healthy plant growth, a process known as liming. approximately 168km from Arapuá.

Given Minas Gerais is the second largest consumer of agricultural limestone in Brazil and that most of Harvest’s clients are also buyers of such product, the Company hope to leverage its commercial channels and regional market know how to rapidly build sales. First, it is preparing a cost-effective exploration programme ahead of developing a preliminary mineral resource and, if favourable, continue with economic and market studies, following the same fast-track route to production as Arapuá.

Notably, the simplicity of a potential operation with free digging, crushing, and packing and the organic nature of agricultural limestone sits perfectly with the Company’s ESG commitment.

The Board and the Company's senior management have significant experience and a proven successful track record in establishing, growing, financing and subsequently monetising early stage mineral projects both in Brazil and globally. They are all based in London (UK), Australia or Brazil.

Executive Chairman

Mr. McMaster has over 20 years' experience in the area of corporate reconstruction and turnaround and performance improvement and 20 years in the mining industry. Mr. McMaster's experience includes founding Highfield Resources, an ASX listed potash company with projects in Spain as well as numerous reorganisations and the recapitalisation and listing of 12 Australian companies.

Mr. McMaster's career to date includes significant working periods in the United States, South America, Asia and India. Mr McMaster was a founding director in venture capital and advisory firm Garrison Capital Pty Ltd, and is currently a director of a number of ASX listed companies.

Non-Executive Director

Mr. Azevedo is both a licensed geologist and lawyer and an independent Member of the Board of Directors of Brazil Minerals Inc, Avanco Resources, Talon Metals and Harvest Minerals Ltd (formerly Triumph Tin Ltd). Mr. Azevedo has over +25 years of business and mining experience in Brazil. He is currently the Managing Partner and FFA Legal, a legal firm he founded with main office in Rio de Janeiro, Brazil, which is focused solely on natural resources companies. His practice is highly active in mergers and acquisitions for companies owning mineral assets and / or operating mining enterprises in Brazil. His experience spans base metals, industrial minerals, diamonds, and precious metals, and he continually works with the highest federal levels of all branches of government in Brazil.

Mr. Azevedo previously worked for Western Mining, Barrick Gold, and Harsco. He assembled land packages that resulted in four initial public offerings of Canadian companies in Brazil (Talon, Avanco, Beadell, Brazilian Gold and Carnavale) since 2004. Azevedo received a Geology degree from UERJ - Universidade do Estado do Rio de Janeiro in 1986, a Law degree from Faculdade Integradas Cândido Mendes in 1992, and a Post degree from PUC-Rio, Pontifícia Universidade Católica of Rio de Janeiro in 1995.

Non Executive Director & Company Secretary

Mr. James has over 20 years of experience in chartered accounting specialising in corporate advisory and reconstruction. Mr. James is a partner of Palisade Business Consulting, which provides accounting, secretarial and advisory services to private and public companies, government and other stakeholders. Mr. James has a Bachelor of Business from the Queensland University of Technology and is a Chartered Accountant

Non-Executive Director

Mr. Penha has over 16 years of experience in capital markets focused on junior mining companies. He has played key roles with both private and publicly traded companies, executing equity raises, implementing listing transactions, and developing corporate and M&A strategies. Past roles include CFO with GK Resources Ltd., Founder and VP Corporate Development with Rio Verde Minerals Development Corp., VP Corporate Development and member of the Board of Directors of Fertoz Limited, VP Corporate Development with Aura Minerals Inc. and General Manager, Corporate Development with Rio Novo Gold (TSX:RN), among other advisory roles for companies listed in Toronto, London and Australia.

Mr. Penha has also worked for nearly 10 years in corporate finance in several capital markets institutions based in Brazil. He holds an MBA (York University, Schulich School of Business), a B.Sc. Economics, (Rio de Janeiro State University) and a Post-Degree in Corporate Finance (Getulio Vargas Foundation, Rio de Janeiro). He has also been a Board Member of the Brazil-Canada Chamber of Commerce (BCCC) and Chair of its Mining Committee.

Harvest Minerals Limited shares are admitted to trading on AIM, under ticker HMI. The Company was admitted to trading by the London Stock Exchange on 7 September 2015 and it is not listed on any other exchanges or trading platforms

Company Name

Harvest Minerals Limited

Company Description

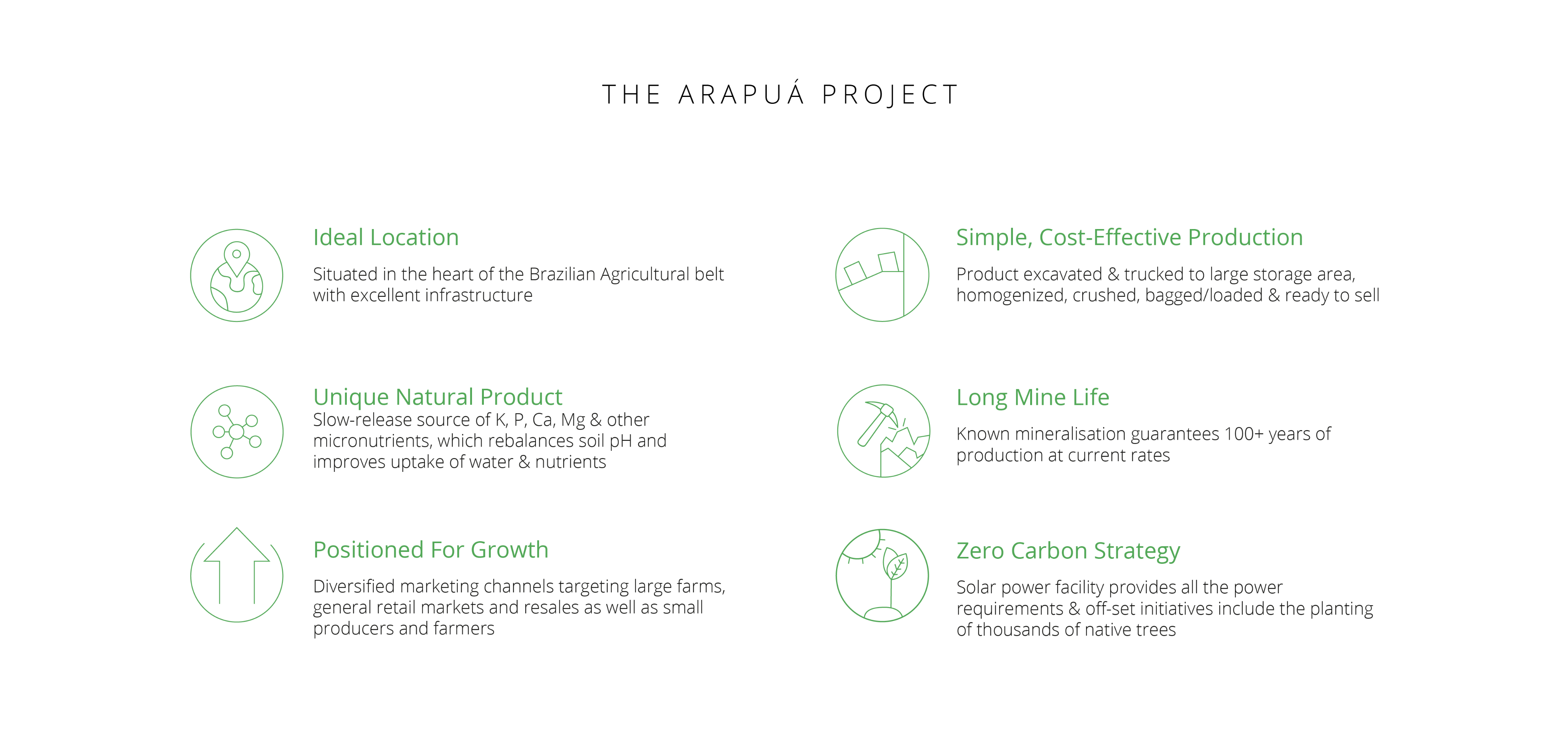

Harvest Minerals is focused on the discovery and development of South American fertiliser or agriproduct projects, which are simple with low technical risk. To this end, its flagship project, the Arapuá Fertiliser Project, which produces an organic fertiliser with minimal environmental impact, is generating increasing revenues following its investment in cost effective sales and marketing campaigns. Additionally, the Company holds four other projects in Brazil, which it will look to develop to production.

Country of Incorporation

The country of incorporation is Australia and the main country of operation is Brazil. Since Harvest Minerals is not incorporated in the UK, the rights of shareholders may be different from the rights of shareholders in a UK incorporated company.

Takeover Code

Harvest Minerals is not subject to the UK City Code on Takeovers and Mergers.

Harvest Mineral is listed on London Stock Exchange’s AIM Market (AIM: HMI)

Directors

The names of the directors and brief biographical details are available on the board and management section of this website.

Admission Document and Constitution

The AIM admission document and company constitution are available here:

AIM Admission Document

Constitution Document

Corporate Governance

STATEMENT OF COMPLIANCE WITH THE QCA CORPORATE GOVERNANCE CODE

Chairman’s Corporate Governance Statement

The Board of the Company, which is responsible for the direction and oversight of its activities, believes that a sound corporate governance policy, involving a transparent set of procedures and practices, is essential to the Company’s success both in the medium and long term. It has therefore adopted the Quoted Companies Alliance Corporate Governance Code (the “QCA Code”) as its benchmark for governance matters. The application of these policies enables key decisions to be made by the Board as a whole, and for the Company to function in a manner that takes into account all stakeholders in the Company, including employees, suppliers and business partners.

My role as Executive Chairman effectively combines the roles of chairman and chief executive although, in practise, much of the day-to-day running of the Company’s operations is delegated to key executives who are not directors of the Company. Whilst this does not satisfy the QCA statement that the “chair must have adequate separation from the day-to-day business to be able to make independent decisions”, this reflects both the entrepreneurial nature of the Company and its business and the continued combination of the two roles will be reviewed as the business develops further.

The Board of Directors currently comprises an Executive Chairman, one other executive director and two non-executive directors. It is the main decision-making body of the Company, being responsible for: a) the overall direction and strategy of the Company; b) monitoring performance; c) understanding risk, and d) reviewing controls. It is collectively responsible for the success of the Company. The Board is satisfied that it has a suitable balance between independence and knowledge of the business to allow it to discharge its duties and responsibilities effectively.

Due to the relatively small size and scale of the Company and its Board, the Directors do not consider it appropriate to appoint a Senior Independent Director and the Company does not operate Audit, Remuneration or Nomination Committees, choosing instead to carry out these functions as a Board.

Jack James, a non-executive director of the Company, is also employed as its Company Secretary and a firm in which he is a Partner of, Palisade Business Consulting, assists with the preparation of its accounts. The Board considers that this does not impair his judgement as an independent director of the Company.

The Company does not currently undertake a formal annual evaluation of the performance of the Board or individual Directors but will consider doing so at an appropriate stage of its development in accordance with general market practice.

The Board maintains a regular dialogue with Strand Hanson, its nominated adviser, and obtains legal, financial and other professional advice as required from Strand Hanson and its other advisers to ensure compliance with the AIM Rules, MAR and other governance requirements.

We continue to review our approach to governance and how the views of stakeholders are represented in our oversight of the business.

The Company’s corporate governance policies and procedures will continue to be reviewed regularly and may change further as its business develops and in response to further regulatory and other relevant guidance.

Brian McMaster

Executive Chairman

Adoption of the QCA Corporate Governance Code

As a company quoted on AIM, Harvest is required to comply with a recognised corporate governance code. At this stage of its development, the Board believes it appropriate for Harvest to adopt the Quoted Companies Alliance Corporate Governance Code (the “QCA Code”), which is specifically designed for growing companies.

This report summarises how Harvest currently complies (or explains why it does not comply) with each of the ten core principles of the QCA Code. Harvest will report further on compliance with the QCA Code on an annual basis.

Principle 1: Establish a strategy and business model which promote long-term value for shareholders

Harvest has a clearly articulated strategy and business plan as a South American focussed natural fertiliser company.

Our business model has been to discover and develop fertiliser and agriproduct projects which are simple to operate with low technical risk. With our existing Arapua fertiliser project in production and generating revenue, we are focused on growing sales and further increasing revenue generation. Whilst we have reduced technical risk as far as possible, the key challenge is in growing sales, and this is being actively addressed through cost effective investment in our sales channels.

Principle 2: Seek to understand and meet shareholder needs and expectations

The Board considers that good communication with shareholders, based on the mutual understanding of objectives, is important. In addition to the information included in the Company’s annual and interim reports and required public announcements, there is regular dialogue between the Board and senior management and shareholders including regular presentations to investors, including one-to-one meetings with major shareholders in addition to specific meetings with shareholders relating to major transactions.

An up to date information flow is also maintained on the Company’s website (www.harvestminerals.net) which contains all press announcements and financial reports as well as operational information on the Company’s activities.

The Board also encourages shareholders to attend the Annual General Meeting, at which members of the Board are available to answer questions and present a summary of the year’s activity and the corporate outlook for the Company.

Principle 3: Take into account wider stakeholder and social responsibilities and their implications for long-term success

The Board believes that long-term success relies upon good relations with a range of different stakeholder groups, both internal and external. Most importantly, however, we act with respect for people, communities and the environment.

As part of our business model, we identify the relationships on which the Company relies, including suppliers, customers, partners and other stakeholders, and seek to maintain and improve these relationships in a number of ways. We regularly seek to obtain, and take action on, feedback from our employees, our suppliers and other parties with whom we transact, as to how we can best maintain and improve our dealings with each other.

Principle 4: Embed effective risk management, considering both opportunities and threats, throughout the organisation

Financial controls

The Board is responsible for reviewing and approving overall Company strategy, approving revenue and capital budgets and plans, and for determining the financial structure of the Company including treasury, tax and dividend policy. Budgeting and planning is undertaken by management in conjunction with the Executive Chairman.

Non-financial controls

The Board recognises that maintaining sound controls and discipline is critical to managing the downside risks to the Company’s plan. The Board has ultimate responsibility for the Company’s system of internal control and for reviewing its effectiveness. However, any such system of internal control can provide only reasonable, but not absolute, assurance against material misstatement or loss. The Board considers that the internal controls in place are appropriate for the size, complexity and risk profile of the Company. The principal elements of the Company’s internal control system include:

The Company continues to review its system of internal control to ensure compliance with best practice, while also having regard to its size and the resources available.

Other areas that will be subject to ongoing review as the Company grows will include regulatory compliance, business integrity, health and safety, risk management, business continuity and corporate social responsibility (including ethical trading, supplier standards, environmental concerns and employment diversity).

Risk management policies

As part of its Corporate Governance Plan, the Company has a number of policies that directly or indirectly serve to reduce and/or manage risk. These include, but are not limited to:

Roles and responsibilities

The risk management and other policies listed above describe the roles and responsibilities for managing risk. This includes, as appropriate, details of responsibilities allocated to the Board.

The Board is responsible for reviewing and approving changes to the risk management policies and for satisfying itself that the Company has a sound system of risk management and internal control that is operating effectively.

The risk management and other policies will be reviewed annually.

Principle 5: Maintain the board as a well-functioning, balanced team led by the chair

The Board of Directors currently comprises an Executive Chairman, one executive director and two non-executive directors. All directors retire by rotation with at least one third submitting themselves for re-election each year at the Company’s Annual General Meeting.

Executive directors of the Company are required to work such hours as are required to fulfil their obligations to the Company and have service contracts with a 12-month notice period. They are not precluded from having other outside business commitments.

The non-executive directors have a letter of appointment with a 3-month notice period and are required to be available to attend Board meetings and to deal with both regular and ad hoc matters. Their letters of appointment provide no indicative time commitment, but they are required to devote sufficient time as may reasonably be necessary for the proper performance of their duties.

The Board considers that the two non-executive directors are independent in character and judgement, and the Company is therefore in compliance with QCA Code recommendation of the Board consisting of at least two independent non-executive directors. As noted above, the Company acknowledges that the combined role of CEO and Chair into Executive Chair does not meet the QCA Code’s recommendation in respect of having a non-executive chair, however this setup reflects both the entrepreneurial nature of the Company and its business. The continued combination of the two roles will be reviewed as the business develops further.

The Board is satisfied that it has a suitable balance between independence and knowledge of the business to allow it to discharge its duties and responsibilities effectively.

During the year ended 31 December 2024, the number of Board meetings held and those attended by each Director were as follows:

| Director | No. of Board meetings eligible to attend | No. of Board meetings attended |

| Brian McMaster | 5 | 5 |

| Luis Azevedo | 5 | 5 |

| Jack James | 5 | 5 |

| Alex Penha | 5 | 5 |

In addition to the formal meeting of Directors above, the Board has held regular and frequent discussions throughout the year and passed circular resolutions on all material matters.

Principle 6: Ensure that between them the directors have the necessary up-to-date experience, skills and capabilities

Experience and capabilities

The Board is satisfied that, between its Directors, it has an effective balance of skills and experience including technical and commercial mining industry knowledge and expertise and experience in sales, operations, performance improvement, finance, commercial law and capital markets. Each Board member brings a mix of different capabilities which blend well into a successful and effective team.

Board members maintain their skillsets through practice in day-to-day roles enhanced with continuing professional development and specific training where required.

Biographies for each Board member are published on the Company’s website and in the Directors’ Report.

Internal Advisory Responsibilities

Due to the relatively small size and scale of the Company and its Board, the Directors do not consider it appropriate to appoint a Senior Independent Director.

All Directors have access to the advice and services provided by the Company Secretary whose appointment and removal is a matter reserved for the Board. Jack James, a non-executive director of the Company, fulfils the role of Company Secretary by, amongst other things, carrying out the following functions via Palisade Business Consulting, a firm of which he is a Partner:

The Board maintains a regular dialogue with Strand Hanson, its nominated adviser, and obtains legal, financial and other professional advice from Strand Hanson and its other advisers as required to ensure compliance with the AIM Rules, MAR and other governance requirements.

Principle 7: Evaluate board performance based on clear and relevant objectives, seeking continuous improvement

The Company does not currently undertake a formal annual evaluation of the performance of the Board or individual Directors but will consider doing so at an appropriate stage of its development in accordance with general market practice.

Given its relatively small size, the Company has no formal succession planning process in place. Recommendations for Board-level and other senior appointments are put to the Board for approval by the Executive Chairman.

Principle 8: Promote a corporate culture that is based on ethical values and behaviours

The Board also believes that a healthy corporate culture both protects and generates value for the Company. We therefore seek to operate within a corporate culture that is based on sound ethical values and behaviours. We do this using certain rule-based procedures (such as our formal Corporate Code of Conduct) and, more importantly, by the behavioural example of individual Board members and senior managers. These values, which we seek to instil throughout the Company, include integrity, respect, honesty and transparency. As a small company, these characteristics are far more visible to staff than might otherwise be the case. We also hold internal meetings at which Directors and staff discuss matters, both formally and informally.

The Company operates a well-defined organisation structure through which we seek to determine that these ethical values and behaviours are recognised and respected, in addition to which every employee is aware of our established whistleblowing procedures.

Principle 9: Maintain governance structures and processes that are fit for purpose and support good decision-making by the board

The Board

The Board is responsible for the long-term performance of the Company. There is a formal schedule of matters specifically reserved for the Board, in addition to the formal matters required to be considered by the Board under the Corporations Act. This list includes matters relating to: a) appointing executive directors and determining their remuneration; b) determining strategy and policy; c) reviewing and ratifying risk management and compliance systems and controls; d) approving major capital expenditure, acquisitions and disposals; e) approving and monitoring budgets and the integrity of financial reporting; f) approving interim and annual financial reports; g) approving significant changes to the organizational structure; h) approving any issues of shares or other securities; i) ensuring high standards of corporate governance and regulatory compliance; j) the appointment of the Company’s auditors.

The Executive Chairman’s role involves both the leadership of the Board (including responsibility for the establishment of sound corporate governance principles and practices) and leading the Company’s executive management team in the execution of its strategy. He also plays a pivotal role in developing and reviewing the strategy in consultation with the Board.

Notwithstanding the QCA Code’s recommendation that the role of Chairman and Chief Executive are not combined, Harvest’s use of an Executive Chairman reflects both the entrepreneurial nature and early stage of development of its business. The Board anticipates that the continued combination of the two roles will be reviewed as the business develops further.

The Executive Directors are responsible for implementing and delivering the strategy and operational decisions agreed by the Board, making operational and financial decisions required in day-to-day operations, providing executive leadership to managers, championing the Company’s core values and promoting talent management.

The Non-Executive Directors contribute independent thinking and judgement through the application of their external experience and knowledge and are tasked with scrutinising the performance of management, providing constructive challenge to the executive directors and ensuring that the Company is operating within the governance and risk framework approved by the Board.

Board Committees

The Company’s Board Charter requires it to establish Audit, Remuneration and Nomination Committees to assist the Board in fulfilling its duties once the Board has determined that it is of a sufficient size and structure. At present, the Board believes that, due to the relatively small size of the Company, its Board and operational business, such committees are not yet required. These functions are therefore currently carried out by the Board:

Evolution of the Corporate Governance Framework

The Company’s corporate governance policies and procedures will continue to be reviewed regularly and may change further as its business develops and in response to further regulatory and other relevant guidance.

Principle 10: Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders

The Company communicates with shareholders through its annual report and accounts, half year reports, quarterly trading updates, its annual general meeting, live investor presentation, and one-to-one meetings with certain existing and potential new shareholders.

The Company’s website includes the outcomes of shareholder votes cast at the Annual General Meeting and historic annual accounts, half-year reports and AGM notices.

In formally adopting the QCA Code as its corporate governance framework, the Board has reviewed all aspects of compliance and has taken action to improve disclosures in its annual report and accounts and on its website

| Shareholder | No. Shares Owned | % Fully Paid Shares |

| Vidacos Nominees Limited* | 87,861,597 | 17.46% |

| Aurora Nominees Limited | 82,940,959 | 16.48% |

| Pershing Nominees Limited | 56,630,000 | 11.25% |

| The Bank of New York (Nominees) Limited | 30,165,519 | 6.00% |

| Hargreaves Lansdown (Nominees) Limited | 29,463,062 | 5.86% |

| Pershing Nominees Limited | 24,587,738 | 4.89% |

| Puma Nominees Limited | 20,196,179 | 4.01% |

| Spreadex Limited | 16,666,666 | 3.31% |

* These holdings include shares held by the directors detailed below.

Number of shares in issue as of 10/07/25 | 503,169,217 |

| Director | No. Shares Owned | % Fully Paid Shares |

| Mr Brian McMaster | 79,842,996 | 15.87% |

| Mr Luis Azevedo | 57,645,135 | 11.46% |

| Mr Jack James | 43,135,200 | 8.57% |

As at 10/07/25

Insofar as the Company is aware, the percentage of shares not in public hands is 36%

Number of shares in issue 503,169,217

There are no restrictions on any shares

Nominated & Financial Adviser

Strand Hanson Limited

26 Mount Row

London W1K 3SQ

United Kingdom

Brokers

Tavira Securities Limited

88 Wood Street

London EC2V 7DA

United Kingdom

Solicitors to the Company

As to Australian law:

Steinepreis Paganin

Level 4, The Read Buildings

16 Milligan Street

Perth WA 6000

Australia

As to English law

Bird & Bird LLP

12 New Fetter Lane

London EC4A 1JP

United Kingdom

Share Registrar

In Australia:

Computershare Investor Services

Level 11, 172 St Georges Terrace

Perth WA 6000

Australia

In the UK:

Computershare Investor Services Plc

The Pavilions

Bridgwater Road

Bristol BS13 8AE

United Kingdom

Auditors

HLB Mann Judd

Level 4, 130 Stirling Street

Perth WA 6000

Australia

Level 1

20 North Audley Street

London

W1K 6LX

Tel: +44 (0) 203 940 6625

Twitter - @HarvestMinerals

22 Lindsay Street

PERTH

WA 6000

Australia Postal Address:

PO Box 8546 PERTH WA 6849 Australia

Tel: +61 8 9200 1847

Fax: +61 8 9227 6390

Av. Jornalista Ricardo Marinho 360, sala 113

Ed. Cosmopolitan Barra da Tijuca

Rio de Janeiro

CEP 22631-350

Brazil

Follow us on Twitter @HarvestMinerals

If you wish to contact us, please fill in the form below: